CADILLAC SECTION 179 TAX DEDUCTION

IN DUBLIN, OH

If you're a small-business owner looking to buy a new Cadillac SUV or car to drive your company to the next level, then you're in luck. Your business may be able to take advantage of the Section 179 Tax Deduction when you buy a new or new-to-you Cadillac model from our Cadillac dealership in Dublin, OH.

What is the Section 179 Tax Deduction? This tax code was designed by the U.S. government to help small- and medium-sized businesses invest in themselves and grow. Whether you're interested in a sleek Cadillac XT4 or a versatile Cadillac XT6 SUV, you'll find just what you're looking for when you shop with us. Have questions about how your business can claim the Section 179 Tax Deduction? Come by our Ohio Cadillac dealer to speak with the Cadillac of Dublin finance experts.

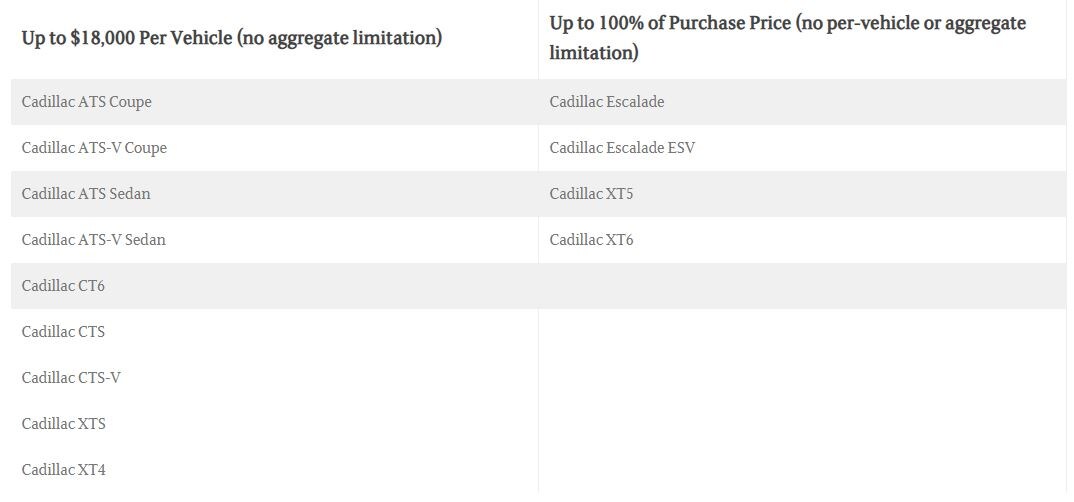

When you take advantage of Section 179 benefits, your business may be able to deduct up to 100% of the purchase price of the new Cadillac Escalade or XT5 SUV you've been eyeing. In order to qualify for the Section 179 Tax Deduction, the vehicle must be used for business purposes at least 50% of the time. Additionally, your desired Cadillac model must be purchased and put into service by December 31, 2019.

WHICH CADILLAC VEHICLES QUALIFY FOR SECTION 179 DEDUCTIONS?

To find out more about how the Section 179 tax write-off can help your business grow and thrive, head to our Dublin Cadillac dealer. The Cadillac of Dublin finance team will happily answer all your questions about the Section 179 qualifications so that you can get behind the wheel of the new Cadillac model your business needs to succeed.